Granting work authorization would have increased sum to nearly $850 million

Boston, MA – Immigrants without status contributed nearly $650 million in state and local taxes to Massachusetts in 2022 according to a new study published by the Institute on Taxation and Economic Policy (ITEP), a non-partisan, non-profit tax policy organization. The study also notes that if all immigrants without status were granted work authorizations, Massachusetts state and local tax revenue would have climbed to nearly $850 million in 2022.

“Instead of letting fear or hate drive the narrative around immigrants, we need to embrace the facts: Immigrants without status contribute hundreds of millions of dollars in state and local tax dollars to our region, fueling the services so many of us depend on,” said Elizabeth Sweet, Executive Director of the Massachusetts Immigrant and Refugee Advocacy (MIRA) Coalition. “Granting those without status work authorization is a common-sense reform that would dramatically increase tax revenues, while helping immigrants feel more safe and welcome in the state and nation they already contribute so much to.”

The study breaks down the specific areas in which immigrants without status generated state and local tax revenue throughout the Commonwealth in 2022. These include:

- $160.7 million in sales and excise taxes

- $209.6 million in property taxes

- $274.4 million in personal and business income taxes

- $5.2 million in other taxes

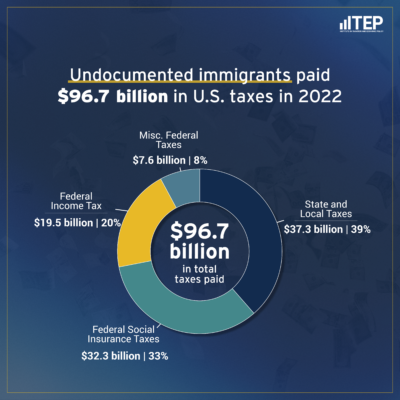

Across the nation, immigrants without status generated $96.7 billion in total taxes paid in 2022, per ITEP’s study. Some key findings on where these funds went include:

- $37.3 billion in state and local taxes

- $32.3 billion in federal social insurance taxes

- $19.5 billion in federal income tax

- $7.6 billion in miscellaneous federal taxes

“This study is the most comprehensive look at how much undocumented immigrants pay in taxes. And what it shows is that they pay quite a lot, to the tune of nearly $100 billion a year,” said Marco Guzman, ITEP Senior Policy Analyst and co-author of the study. “The bottom line here is that regardless of immigration status, we all contribute by paying our taxes.”

“The contributions of undocumented immigrants have long been crucial to Massachusetts’ economic growth,” said Phineas Baxandall, Interim President of the Massachusetts Budget and Policy Center. “This report shows how these immigrants make significant contributions directly to our tax base as well, helping to fund the schools, police and fire departments, and so many other essential services residents turn to on a daily basis.”

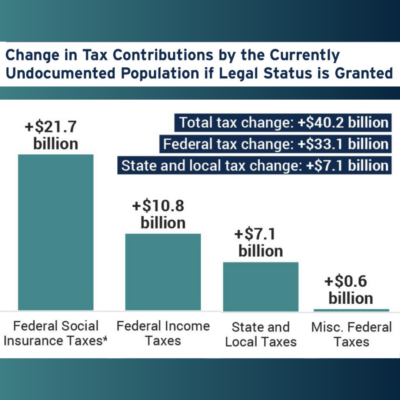

The report stresses the benefits states like Massachusetts would receive if all immigrants without status were to attain work authorization. These immigrants would have generated nearly $200 million more in state and local taxes for Massachusetts, and about $40 billion more in tax revenue nation-wide. As a result, providing work authorization to immigrants without status in Massachusetts and across the U.S. would not only provide a path forward towards independence for the many who seek to call here home, but benefit our state and nation financially too.

You can read the full ITEP study here.